omaha nebraska vehicle sales tax

The price you see is the price you pay to buy a car at our. The tax only applies to the City of Omaha not other cities around Omaha.

Nebraska State Tax Things To Know Credit Karma Tax

Download all Nebraska sales tax rates by zip code.

. Department of Revenue Form 6 Nebraska SalesUse Tax and Tire Fee Statement. The statistics are grouped by county. The Nebraska sales tax rate is currently.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Are subject to an extra 25 tax. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

Pick one up by contacting the Nebraska Department of Revenue or at your County Treasurers office. Omaha Ne Sales Tax Calculator. Download all Nebraska sales tax rates by zip code.

This is the total of state county and city sales tax rates. Lincoln and Grand Island are currently the only other cities in Nebraska with a restaurant tax. Welcome to Gretna NE.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. Restaurants In Matthews Nc That Deliver. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha.

700 Is this data incorrect Download all Nebraska sales tax rates. 100K for married couples filing. 1500 - Registration fee for passenger and leased vehicles.

4 rows The current total local sales tax rate in Omaha NE is 7000. 2020 rates included for use while preparing your income tax deduction. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger.

2020 Sales Tax 55. Essex Ct Pizza Restaurants. Income Tax Rate Indonesia.

Omaha NE Sales Tax Rate. You can find more tax rates and. Nebraska has a 55 statewide sales tax rate but also has 295.

The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax. The minimum combined 2022 sales tax rate for Omaha Nebraska is. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on.

Opry Mills Breakfast Restaurants. A NE Department of Revenue Nebraska SalesUse Tax and Tire Fee Statement Form 6. That brings the total tax to 95 25 restaurant tax 7 Omaha sales tax.

402 337-5025 BMW of Omaha Sales. The latest sales tax rates for cities in Nebraska NE state. 2020 Net Taxable Sales.

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Delivery Spanish Fork Restaurants. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. Plattsmouth NE Sales Tax Rate. Soldier For Life Fort Campbell.

The December 2020 total. Papillion NE Sales Tax Rate. Rates include state county and city taxes.

The Registration Fees are assessed. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger. You can find more tax rates and allowances for Omaha and Nebraska in the 2022 Nebraska Tax Tables.

2021 Sales Tax 55. Omaha Nebraskas Sales Tax Rate is 7. 337-4008 Land Rover Omaha Sales.

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. You can find these fees further down on the page. Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15.

Offutt Air Force Base NE Sales Tax Rate. This is the total of state county and city sales tax rates. The County sales tax rate is.

Restaurants bars movie theaters arenas etc. Enterprise Car Sales offers no-haggle pricing on a large selection of used cars in Omaha NE. The Omaha sales tax rate is.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax. This example vehicle is a passenger truck registered in Omaha purchased for 33585.

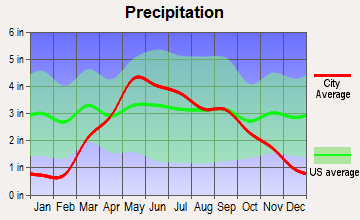

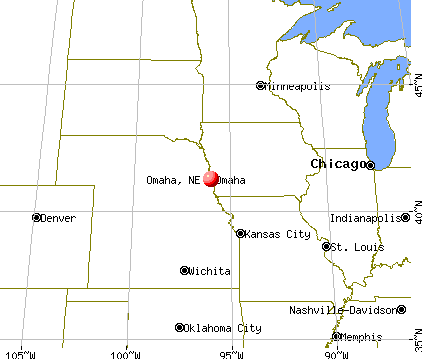

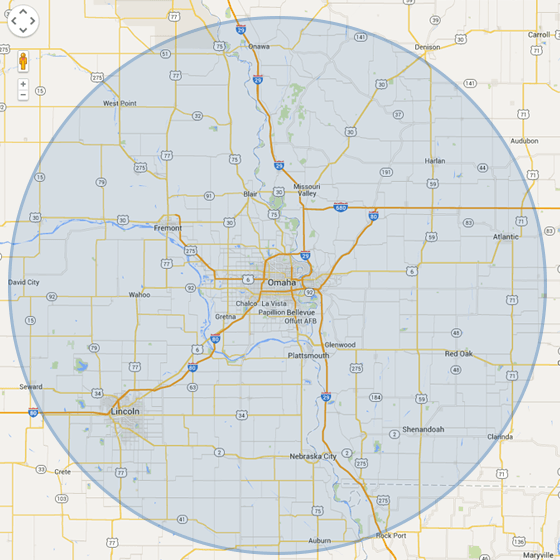

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Moving To Omaha Nebraska The Truth About Living Here

Map Of Peony Park Vintage Beach Posters Omaha Nebraska Vintage Beach

Fenway Park Motors In The Late 1950 S Cool Old Cars Old Pictures Boston Pictures

Motor Vehicles Douglas County Treasurer

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Atm Company In Omaha Lincoln Nebraska Prineta Usa Prineta Usa

Greater Omaha Chamber Of Commerce Plates Nebraska Department Of Motor Vehicles

Rent To Own Auto Centers 4310 L Street Omaha Nebraska 68107 Home Facebook

Omaha Ne Moving Tips And Services

Safest Neighborhoods In Omaha For Families

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales Tax On Cars And Vehicles In Nebraska

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Rent To Own Auto Centers 4310 L Street Omaha Nebraska 68107 Home Facebook

Atm Company In Omaha Lincoln Nebraska Prineta Usa Prineta Usa

Pros And Cons Of An Open House In Omaha Nebraska Sell My House Fast Sell My House Open House